- What is the Double Top Pattern candlestick pattern?

- Does the Double Top Pattern candlestick pattern actually work?

- Key Differences between technical and fundamental analysis

- What Are The Advantages and Disadvantages of Trading with Double Top Pattern?

- Examples of famous traders who use the Double Top Pattern candlestick pattern

- How many types of Double Top Pattern candlestick patterns are there?

- How to trade a Double Top Pattern candlestick pattern

- A Double Top Pattern candlestick pattern trading strategy

- What are the Double Top Pattern candlestick pattern trading platforms?

You can learn essential chart patterns that help you anticipate when a trend will reverse. One such pattern is the Double Top. This is one of the more reliable patterns that signal a coming downtrend in prices.

Once you learn to recognize this candlestick pattern, you can see the best point to get out of a position and take your profits. Read on to identify the pattern itself, as well as the best place to sell.

What is the Double Top Pattern candlestick pattern?

This is what is known as a reversal pattern. It indicates that an uptrend may be ending and a downtrend beginning because buyers are getting tired. Prices are approaching a resistance level This will be the formation of the first top. Sellers could take over, driving the price down. When there are more sellers than buyers, prices drop. The Double Top chart pattern shows that buyers try twice to move prices higher and fail at the second top. Hence, “Double Top.”

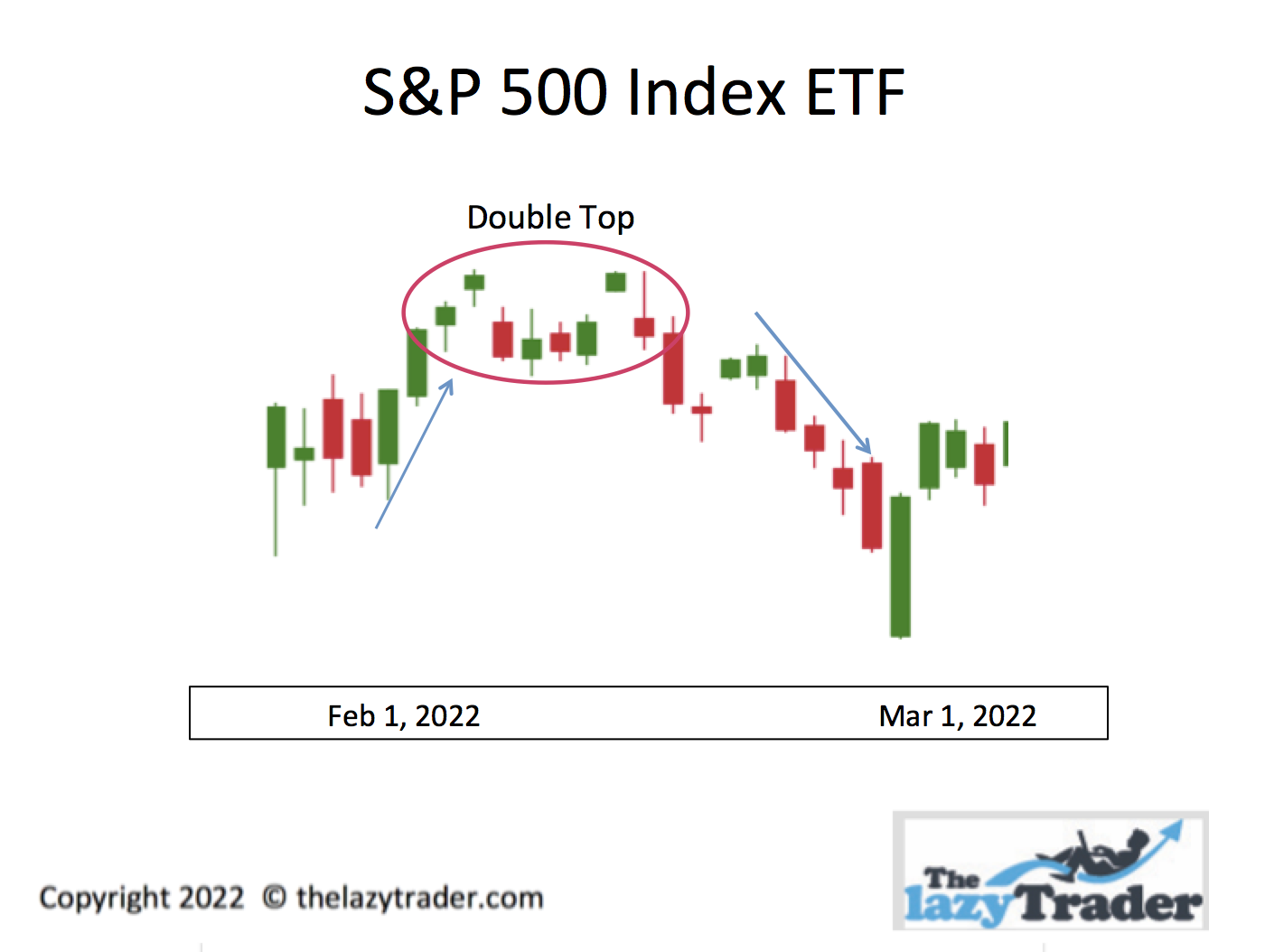

Here is a real-world double top from the S&P 500 Index ETF that occurred from February to March of 2022. You can see that the second peak in this chart pattern set off a retracement of prices.

Does the Double Top Pattern candlestick pattern actually work?

The Double Top chart pattern does work, though you should be aware that no pattern works all the time. That said, this is one of the more reliable patterns because it gives you two warnings. In fact, it is best to wait until the second warning to take action. This delay means you don’t have to make split-second decisions. Use this pattern to make a calm, purposeful trade.

You should be aware that the Double Top pattern is part of technical trading, as opposed to fundamental trading. Let’s look at some key differences.

Key Differences between technical and fundamental analysis

Technical traders look at

Chart patterns

Trends

Known formations

How prices have behaved in similar situations

They look for reversals of trends

Fundamental traders examine:

Sales reports, profits, and for a company

Growth projectionsThe Double Top chart pattern does work, though you should be aware that no pattern works all the time. That said, this is one of the more reliable patterns because it gives you two warnings. In fact, it is best to wait until the second warning to take action. This delay means you don’t have to make split-second decisions. Use this pattern to make a calm, purposeful trade.

You should be aware that the Double Top pattern is part of technical trading, as opposed to fundamental trading. Let’s look at some key differences.

- Sales projections

- Overall economic conditions

In practice, traders may use both approaches, but they tend to lean more toward one of them.

What Are The Advantages and Disadvantages of Trading with Double Top Pattern?

The pattern makes trading more objective – When prices are making big up-and-down moves, it is easy to get emotional and make bad decisions. The Double Top pattern makes it clear what prices are doing objectively and organizes your understanding into distinct stages.

It is a proven technique – Double Tops have proven themselves time and again. It is not a guarantee of a bearish reversal, but it strongly suggests one. The Double Top has been used for a long time. It dates to the 18th century. Munehisa Homma, a rice trader in Japan, noticed patterns and developed a method to track them.

Accessible and easy to understand – You can access charts on many platforms and readily see Double Tops. They are simple to read and easy to interpret.

It helps to provide clarity –Visualizing price action near the top of a trend helps you understand a pattern. Simply checking prices each day won’t give you a sense of what is happening.

It reflects the psychology of the market – Price action tells you what people think an asset is worth. When a price chart shoots up or falls, you know they are gaining or losing enthusiasm. Note that even if you have not reached your profit target, this bearish reversal pattern may tell you it’s time to get out of your long position.

It lags as an indicator – A Double Top forms as you watch, but you can’t be sure it is one until the pattern is complete. You may not want to make a decision before then.

It can be ambiguous to trade double tops when viewed on multiple timeframes – The longer a Double Top takes to form, the more other patterns may interrupt it or make it hard to read. A long Double Top seldom makes a nice, neat “M” shape.

Viable trade setups can be invalidated by unpredictable news or data releases – Sudden news can disrupt a pattern. If traders get emotional in response to an event, they may start panic selling or begin buying based on a rumor. You can overlook important news about a company because you are convinced about what a price pattern seems to be telling you. If you dedicate yourself entirely to a technical approach, you could miss major company announcements that can affect the price.

You might also overlook economic reports – For example, if the economy is headed into a recession, many patterns will fail. You can be caught “off guard” by focusing on price action for an asset and ignoring the economic environment.

Examples of famous traders who use the Double Top Pattern candlestick pattern

How many types of Double Top Pattern candlestick patterns are there?

The difference in Double Top patterns depends on how long they take to form.

Very quick ones may take a few days to form. These are the least reliable because they may not shake out all the buyers. This short pattern is for day traders who want to get in and out fast.

Medium ones can take two to three weeks to form. You can see the pattern developing slowly and start planning to sell your position.

Double Tops that take a couple of months tend to be more reliable as a bearish indicator. Watch for the pattern to move below the moving average when the price breaks downward. It may break downward through a support level, creating a trend reversal. If it doesn’t it may go back up and retest the recent high.

How to trade a Double Top Pattern candlestick pattern

It’s easy to see a Double Top long after it has formed. Let’s look at how to recognize one while it is developing.

A Double Top Pattern candlestick pattern trading strategy

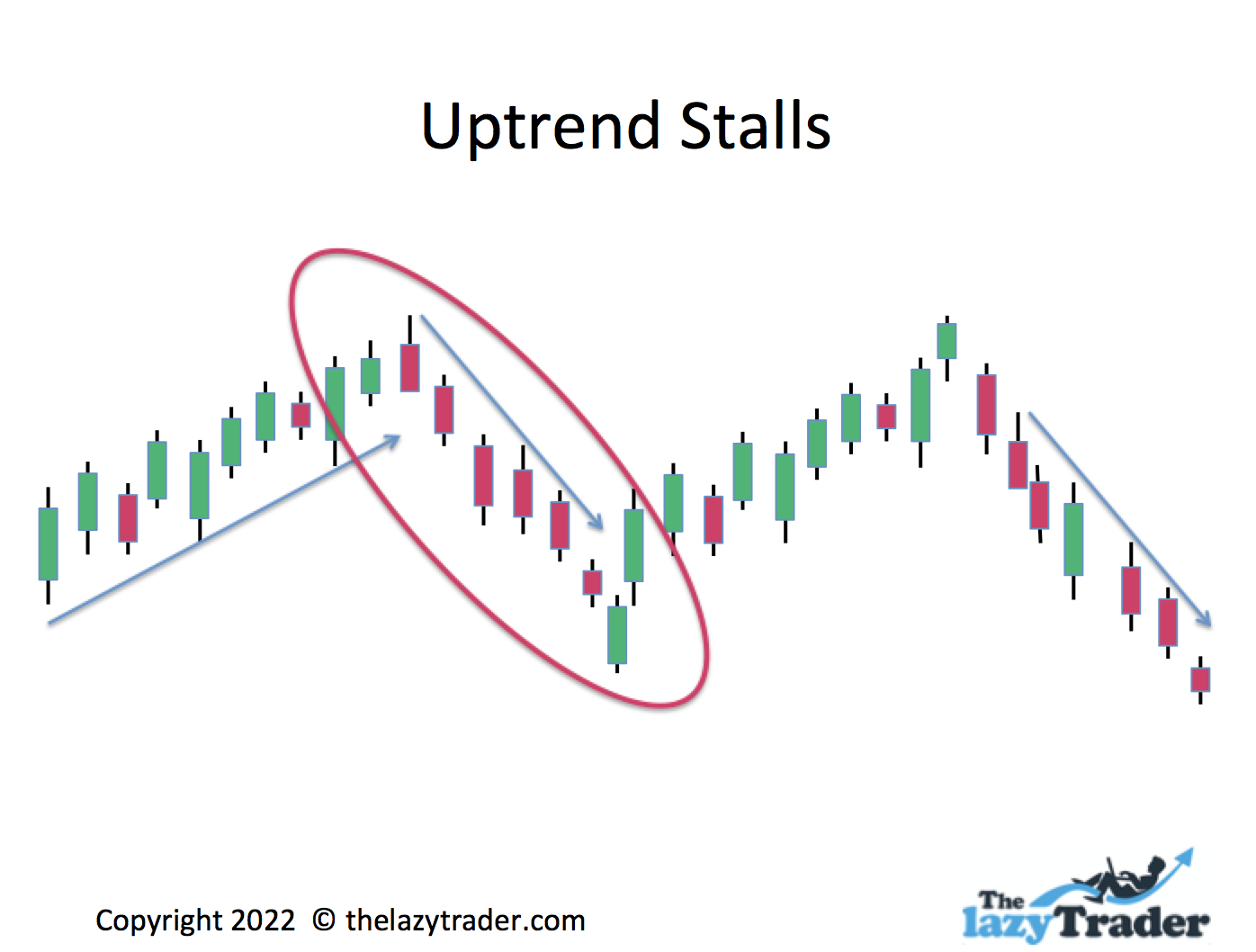

Uptrend hesitates or stalls

If prices have been going up for a long time–as in weeks–you might see some hesitation or a slight drop. This does not mean by itself that a Double Top is forming. It means you should start paying attention. The first peak is not a sign by itself that your should sell must wait to see if the second upward move breaks through resistance or turns downward.

This could be a slight pullback after the first peak, instead of a bearish breakout. If you want to stay in and see if prices go higher, hold on for now. However, if you have good profits already, you can take them here. Long-term traders tend to wait and see at this point. They watch for the double top to go below the “neckline” before they sell.

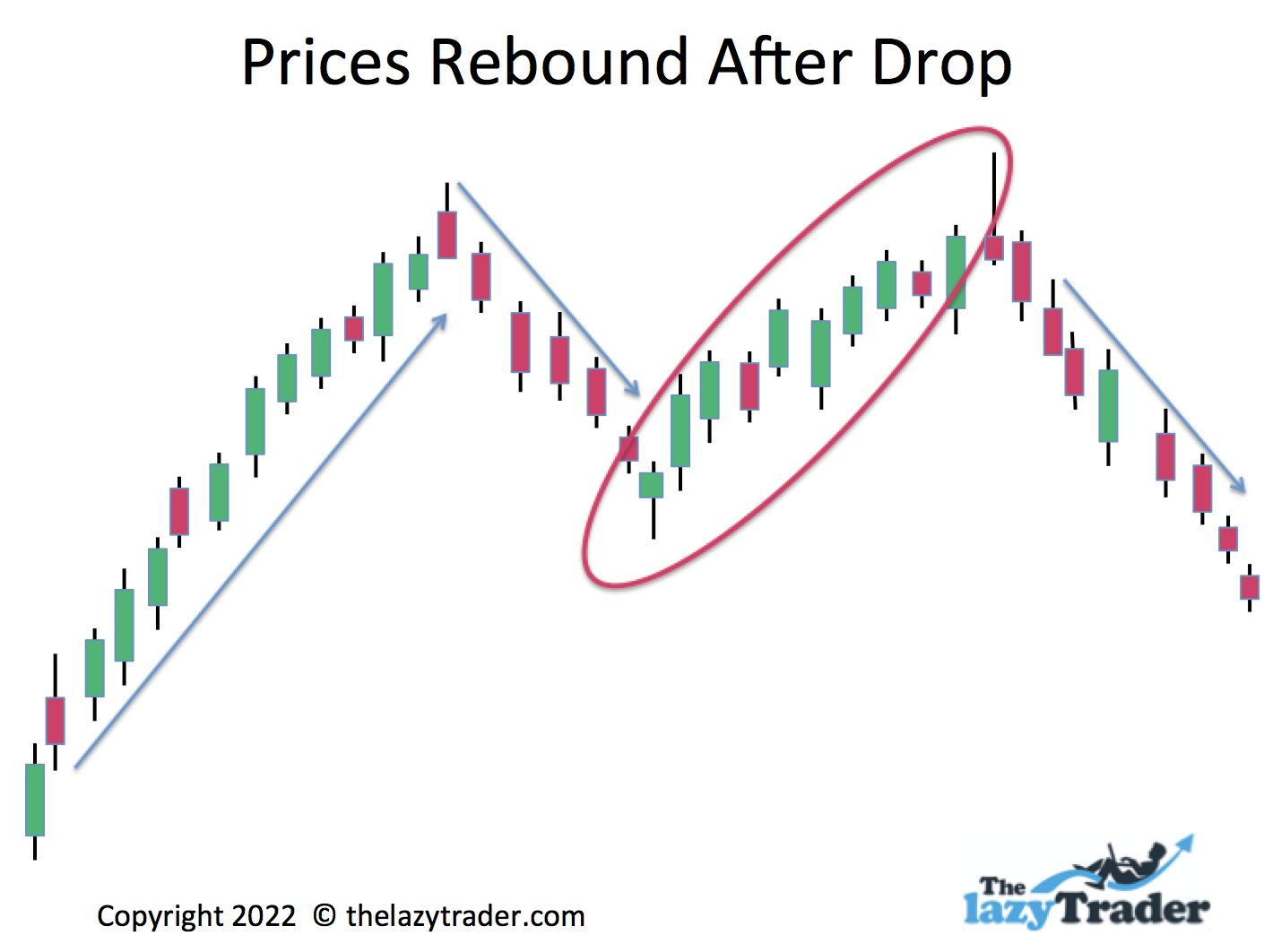

Prices drop, then head back up.

After a drop, you see prices turn and head higher. You now have a decision to make. If prices reach the level of the previous high, will you sell and take your profits?

Reaching the high again does not by itself mean you have a Double Top. It could go higher. It might be best to see if prices will drop from that level and break the neckline before making your decision. In other words, the second rise could be bullish.

The rise back up can be set up for you to get ready to sell.

Prices reach the old high and head down

The Double Top has formed.

The fall from the second high indicates prices will drop much further. Buyers have been “shaken out.”

What are the Double Top Pattern candlestick pattern trading platforms?

TD Ameritrade

This platform works well for technical traders. You can see a variety of charts to identify patterns, and this includes, of course, the Double Bottom pattern. You can go straight from the chart to placing a trade order.

There is no cost for online trades, and you can trade from your phone if you prefer. You can use the paperMoney account to practice trading without actually investing money.

eToro

This site offers a wide variety of investment vehicles, from stocks to cryptocurrencies. The stock offerings are worldwide, making this a google place to invest internationally. The charts are easy to read, making it easy to spot Double Bottoms and other patterns.

The demo account works in real-time so you can watch patterns develop and track what your profits and losses would have been if you had invested money. Stock trades are free.

Capital.com

This is a good place for beginners. You open a free account and get immediate access to the demo version. The site includes thousands of international stocks. When you decide to start investing, the minimum deposit is only $20. You will find good educational and research sources here.

Fidelity

You can trade stocks from 25 markets worldwide. Importantly, you can buy fractional shares. This is good for expensive stocks where one share can cost hundreds or even thousands of dollars. You can buy a fraction of a share for much less. The demo account, Active Trader Pro, allows you to place as many as 50 orders at once (no actual money is invested). You can use technical indicators and create your won charts.

Trading 212

You can access the free demo without even opening an account. Here you can “paper trade” thousands of stocks from the U.S., the U.K., and Europe. Even when you decide to open an account and invest real money, there is no charge for trades.

5 Tips for Successful use of a Double Top Pattern candlestick pattern

- Choose your sell point according to your risk tolerance. If you recently entered the position and have little or no profit, you may want to sell early in the pattern. If you have profit built-in, you can wait until later in the pattern to confirm that it is indeed a Double Top.

- Look for confirmation. When the last leg goes lower than the middle part of the “M,” you have confirmation.

- Use a stop-loss order. After the first drop, when prices rise again, you can place an automatic order to sell if the price drops below the recent low.

- Check to see if the market is following the same pattern. If it is, you may have confirmation that your stock will rise and fall with the market. Check here to see what the index is doing.

- Make one decision. Don’t jump in and out of the position repeatedly. Once you decide to sell, wait for a reversal pattern that tells you prices are going to trend upward.

Double Top Pattern candlestick pattern: General terminology

Trend – A Trend is a sustained price direction (either up or down). “Sustained” usually means weeks. For example, traders usually call a brief downtrend a “dip” or a “pullback.”

Pattern – Over time, the price action will form a “shape.” Traders have come to recognize that these shapes have occurred throughout trading history.

Reversal Pattern – A reversal is a change in price direction. There are reversal patterns when prices reach a top or a bottom. You should know both. If you sell as the result of a Double Top, prices may reverse and go back up at some point. Know your patterns.

Stop-Loss Order – You place a sell order that automatically triggers if prices drop to a specific point. You choose this based on your tolerance for losses.

Limit Order – This is a buy order that specifies the price at which you want the trade to execute. In other words, it is the most you are willing to pay. You can miss an opportunity if the price jumps up dramatically and is higher than the limit you set.

Getting Stopped Out – This happens when you set a stop-sell order too close to the current price. Normal fluctuations can cause the price to drop momentarily, triggering a sell when you don’t want one. Look at the price history and determine how much it fluctuates as a rule.

Target Price – Many analysts name a target price for an investment, meaning they think it will rise to that point. Don’t follow these blindly. Analysts can be wrong, and they never tell you what pullbacks and drops may occur on the way to the target price.

Trading the News – Sometimes the market responds to good or bad news. You may get the feeling you need to jump in or get out. The problem is that these are often overreactions. Trading the news is day-trading, not long-term investing. Pick your approach and stick with it.

Best Practices

Establish whether double top trading is for you

You have to be comfortable with technical trading in general and the Doube Top in particular. Though some suggested sell points can be shown, patterns don’t always form nice neat shapes, and you will have to do some interpreting.

What do you have to be prepared to do:

You must be prepared to watch price action daily so you can catch the pattern forming at the beginning.

Manage your expectations

Learn patience. Stick to your rules and use a slow, steady approach to creating wealth. This is investing, not gambling. The Double Bottom offers you time to make and execute a strategy, and once you have your plan, stick with it.

Risk management

In addition to setting your automatic sell orders, you can limit your risk by placing 1-2% of your account value into any trade. Never put more than that into any single asset purchase.

Select a proven strategy with objective rules for entry and exit

The critical word to remember is “proven.” Simply making rules up is not a proven strategy. You have the benefit of decades of successful investing by others. Do some research.

Keep a trade journal of your trades.

Track your trades and determine how many were successful. Then look at the successful trades and learn why they worked, what signals you interpreted, and whether you chose a good entry point.

Also, look at the losers to see if there is something you should have noticed. Keep in mind, however, that there will always be a percentage of losing trades. Some investments don’t go in the direction the pattern would suggest.

The difference: double bottoms vs. double tops

In addition to the Double Top, you will hear about the Double Bottom chart pattern.

Here’s the difference between a double top and double bottom:

A Double Top formation occurs at the end of an uptrend and indicates prices could go down. A Double Bottom occurs at the end of a downtrend and indicates prices could go up. Compare them in the chart below.

The two patterns do not necessarily follow each other. in such a short period of time. They are shown together here so you can compare them.

Conclusion

The Double Top pattern can be your friend if you take it slow. If you already have profits in your position, then selling a bit too early does little damage. But if you are in for the long-term, such as five to ten years, you could bail out of a position that may have provided stellar profits down the road.

It is essential that you study, track your winners and losers, and learn, learn, learn. Never claim you are an expert; consider yourself a lifelong student of investing.

Frequently Asked Questions (FAQs)

How do you know if you have a Double Top pattern?

You should see two peaks with a downward move in between. It looks like the letter “M.” Note that the final leg of the “M” continues downward indefinitely.

What happens after a Double Top pattern?

The final leg of the “M” continues downward indefinitely until you see a reversal pattern that sends prices back up.

When should you trade a double top?

It is important that you see an uptrend before a Double Top pattern. The longer the uptrend, the better.

Do Double Top trading setups work?

They are a strong indicator. What makes them strong is that the high price is tested twice. That said, they can fail, so watch closely when one forms.